Introduction

We launched Air Street Capital in 2019 after I'd been investing in AI-first companies since joining the venture industry in 2013. I recall a 2015 essay I'd written in TechCrunch in which I made the case for investing in AI. In 2017, I reiterated the case for going long on AI. The progress we've seen in AI technology and industry applications over the 10 years since my start in VC is astounding.

Although AI, and in particular generative models, appear to have been voted a consensus investing theme in the wake of a market recession and crypto crash in H2 2022, it is still arguably Day 1. Without further ado, here is a 2022 Year in Review from Air Street and our work on Spinout.fyi, State of AI Report, London.AI and RAAIS.

Portfolio updates

In 2022, we looked closely at >300 opportunities and many more before a round (or company for that matter!) was at play.

Fund 1 made 3 new and 5 follow-on investments. We raised Fund 2, which made 2 new investments. We set up 2 SPVs for 1 new and 1 follow-on investment. Now, for some highlights in chronological order:

🔬 Gandeeva Therapeutics, Jan '22

$40M maiden round for their cryogenic electron microscopy and AI-first drug discovery platform. Led by Sriram, a world leader in cryoEM with lots of high-impact research to his name.

💻 Athenian, Mar '22

$6M Seed to bring end-to-end visibility to how software is delivered. Organizations improve the velocity and quality of their eng orgs. Led by Eiso, one of the most principled and data-driven founders I've met!

🛰️ Modern Intelligence, Mar '22

$5M Seed to build one AI for defense. It is clear that democracies must revamp their defenses to deter conflict and safeguard freedom. AI is key to this. John Dulin and Tristan Tager are deeply committed to service the US warfighter.

🤖 Adept, Apr '22

$65M maiden round to build general intelligence by enabling people and computers to work together creatively. ACT-1 is a large model that can take actions on the web. Led by David Luan and senior researchers/engineers from OpenAI, Google Brain, and DeepMind.

⚗️ Anagenex, June '22

$30M Series A to generate new chemical matter against hard-to-hit targets using a closed loop DNA-encoded library and ML approach. Nicolas, CEO/founder, knows the ins-and-outs of this tech from his PhD and built Anagenex into a unique player.

🧪 Hedera, Sept '22

$9M Seed to bring liquid biopsies to cancer patients across Europe. Enabling hospital labs to run clinically actionable liquid biopsies in-house. Led by an experienced team of repeat founders and clinicians, Tommi, Christian, and Damien.

🦆 Gourmey, Oct '22

$48M Series A the world's largest A for cultivated meat, to reinvent foie gras and other unannounced fine foods. Led by Nicolas, Victor and Nadine who pack so much ingenuity into one biz it is 🤯.

📸 V7, Nov '22

$33M Series A to accelerate the industry's increasingly favorite data engine for AI. A labor of love from Alberto and Simon who've been in the trenches building production AI systems since 2015.

🥗 ZOE, Dec '22

$30M more fuel for the personalized nutrition program backed by the world's largest nutrition-science study. Led by the all-star entrepreneur and scientist cast of Tim, Jonathan, Sarah, and George.

Team updates

To help Air Street scale amidst all this portfolio activity and our big plans for the future, I MORE THAN HAPPILY welcomed Paula Pastor Castaño to the team in Apr '22.

...and 9 months in, I am still MORE THAN HAPPY 😎.

We also started a Venture Fellowship program for graduate students to work with us full- or part-time. Othmane Sebbouh joined as our first Venture Fellow from École Normale Supérieure in Paris where he's pursuing a PhD in machine learning. Together we've worked on investments and special projects including State of AI Report, the "Guide to AI" newsletter, Spinout.fyi and more.

Writing

We did lots of writing in '22! Together with Othmane, we produced 6 editions of the "Guide to AI" newsletter. In it, we analyze the most important AI tech, research, geopolitics and startups. We've now surpassed 19,000 subscribers. You can read and subscribe more below:

Community

We relaunched in-person London.ai meetups (you can keep tabs on future events here)! Each one welcomed 100-150 hand-picked AI founders, operators, researchers and students for an evening of 3 talks and mingling. Both events were PACKED, and we're looking forward to an in-person RAAIS conference in June 2023!

pre-Air Street and angel portfolio

Finally, a handful of my angel and pre-Air Street portfolio companies raised great rounds in 2022. These include:

🏦 Thought Machine $160M Series D

🏭 Crusoe Energy $350M Series C

🏎️ Wayve $200M Series B

☎️ PolyAI $40M Series B

🛰️ Muon Space $25M Series A

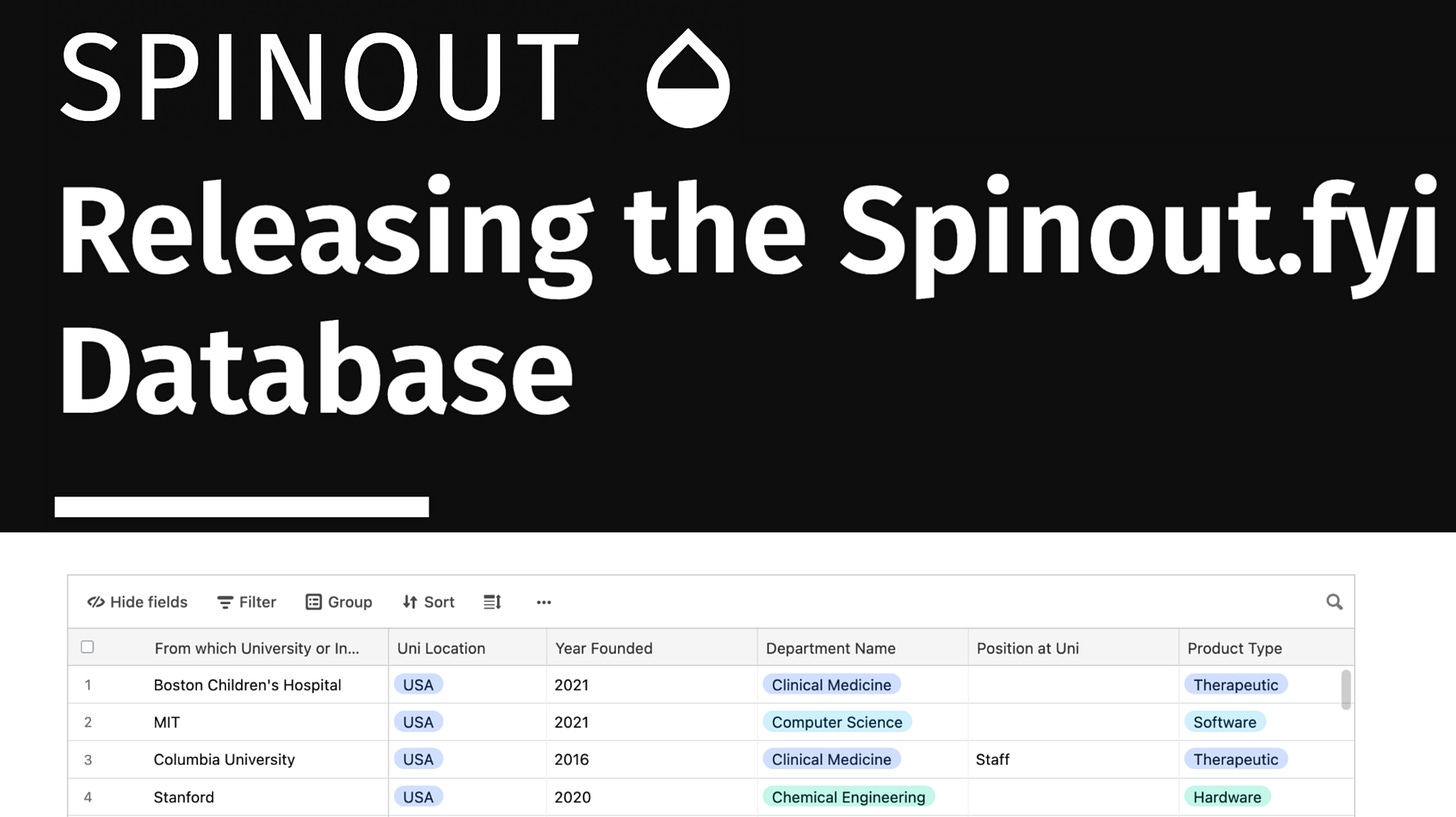

Spinout.fyi

The world's most needed and impactful technologies emerge from our universities, but inventors still struggle to build companies from their work. In June '22, we open sourced 143 spinout deal terms from 71 global universities.

This is the largest open, free, and global dataset of its kind. Spinout.fyi illuminates deal term practices from universities, exposing a) lengthy, opaque negotiations, b) very high value capture mechanisms (equity, royalties, milestones), c) low NPS 👎

We presented simple and cost-effective policy recommendations that can unlock the creation of spinouts on terms that favor their success. These include:

Implementing new and openly accessible KPIs by which to measure TTO performance

Funding from government for "proof-of-spinout" experiments

Adopting a "simple agreement to spinout" with permissive terms

Encouragingly, the UK's Labour Party produced a startup review in which these recommendations were written in 💪. Other nation states are making moves in this direction, recognizing the potential that spinouts offer for tech sovereignty and growth.

We've now reached over 200 submissions in the Spinout.fyi database and will prep a v2 data launch soon. This is a global issue. Help us grow further by sharing this survey with anyone whose built or considered building a spinout from their research:

State of AI Report

Our goal is to create a canonical open source resource that analyzes progress in AI. In Oct '22, we released our 5th edition of the State of AI Report and have so far clocked 40% more traffic than last year's. Progress, excitement and attention in AI is palpably 🔥

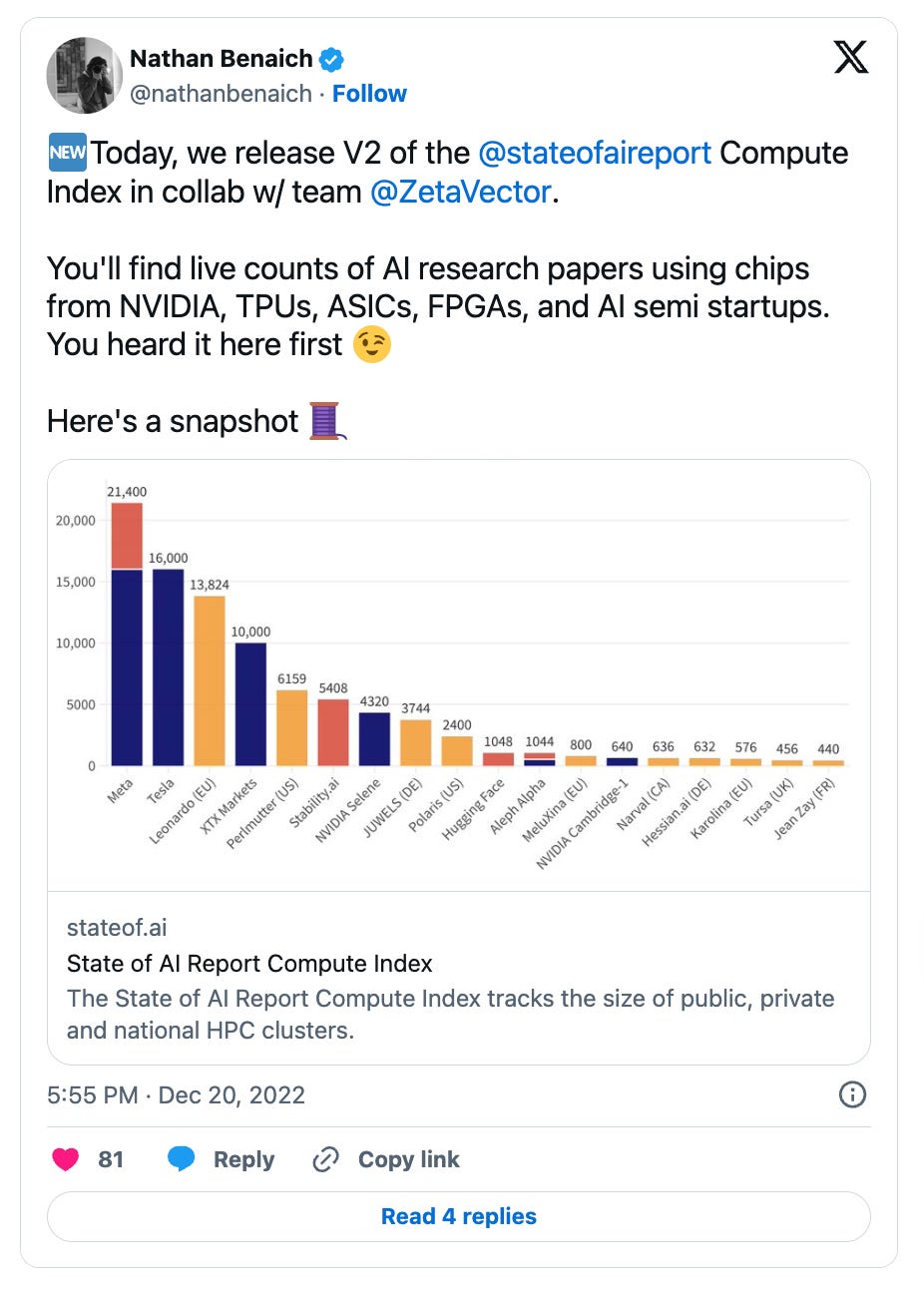

A major theme we found in collaboration with Zeta Alpha is the previously undocumented, yet immense, concentration of compute resources to NVIDIA vs. all other alternatives. In Nov '22, we launched the State of AI Report Compute Index to track this.

Lots of great State of AI Report coverage came out since we published (Fortune, FT, Bloomberg, Sifted, Economist) and slides have popped up in lots of fun places, e.g. Emad's launch presentation for StabilityAI and an unexpected shout out on the My First Million podcast.

Here is State of AI Report called out in Dec '22 The Economist's "Artificial intelligence is permeating business at last" in print :-)

Towards the end of '22, (generative) AI really went into overdrive with the rapid proliferation of high-quality text-to-image/video/music, ChatGPT and rumors of massive AGI startup funding. I had the chance to discuss this with Eric Newcomer on Newcomer Dead Cat Show.

I also had a blast with Daniel Bashir on The Gradient Podcast discussing geopolitics, AI investing, AI-first bio and more!

In Mario Gabriele's The Generalist, I had the chance to pitch generative AI for life science as a major theme to watch in AI...

If you're interested in AI-first bio, some more here in Financial Times' The Big Read earlier in '22..."Funding for AI in drug discovery has risen 3,800 per cent in the past five years to $2bn".

To the 12 months of 2022, that's a wrap!