A new institution for the mass affluent

For more than three centuries, wealth in the United Kingdom has been shaped by institutions like Coutts, founded in 1692 and long associated with a model of personalised service reserved for a narrow segment of society. That heritage has defined expectations of advice as something scarce, relationship driven and costly to deliver. Today that world looks very different. The mass affluent have grown in number and complexity, accumulating meaningful assets while facing a financial landscape defined by rising volatility, shifting pensions, tightening tax regimes and the largest generational transfer of wealth in modern UK history. At the same time, the institutions that should support them have not kept pace. Advisors are scarce, legacy systems are slow and the burden of navigating important long term decisions has fallen back onto individuals.

It is against this backdrop that Air Street Capital is investing in Clove’s $14M first financing round, backing a new kind of wealth institution built for this generation rather than the last. This investment reinforces our long-term thesis that AI-native financial institutions will reshape how wealth is planned, managed and delivered.

Clove’s founders, Christian Owens and Alex Loizou, see this gap not as an inevitability but as the result of infrastructure that was never built for the modern consumer. With Clove, they are creating a new kind of financial institution, one designed from the ground up for people who want trustworthy guidance but have been priced out or ignored by traditional services. Their platform brings together regulated human advisors with an AI-first environment that handles the repetitive and compliance heavy processes which dominate advisory work today. By removing friction and expanding advisor capacity, Clove can deliver high quality personalised guidance at a scale that has not been possible before.

Rebuilding the wealth stack

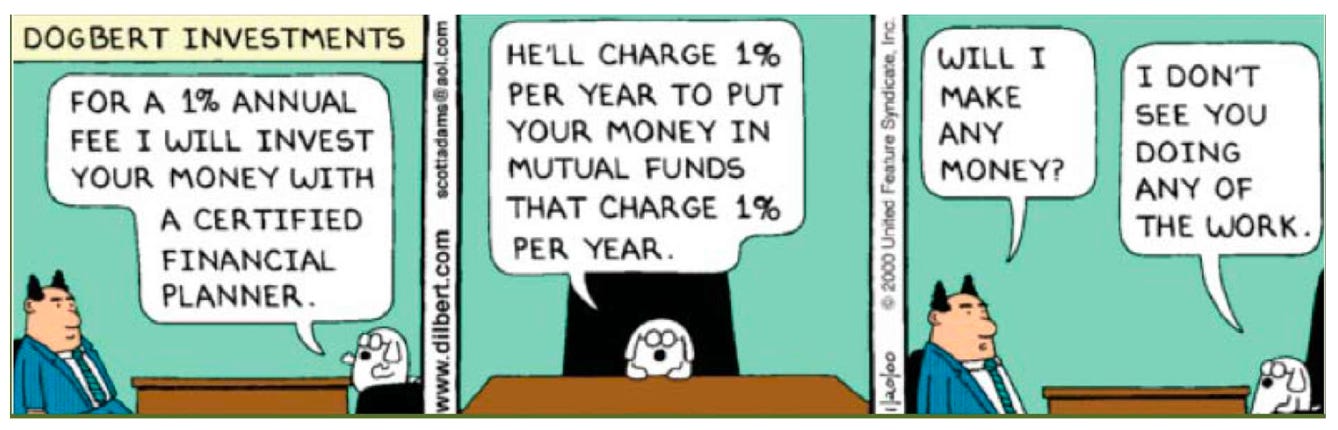

The scale of the advice gap in the United Kingdom captures both the urgency and persistence of this problem. Thirteen million households hold between £50k and £5M in investable assets, yet nearly three quarters of them receive no professional guidance. Many are left to navigate pensions, taxes and long term decisions alone, despite the growing complexity of the financial landscape.

This lack of support is reflected in the way people use even the simplest tax efficient investment tools such as the ISA. Only around 40% of adults hold an ISA and fewer than 10% of ISA holders use their full £20,000 personal allowance each year. This illustrates a broader pattern in which millions of people with meaningful savings struggle to make informed choices. DIY investing platforms were designed for trading rather than long term planning and regulatory efforts aimed at transparency cannot compensate for the operational limits of institutions that still rely on outdated processes.

Clove is stepping into this gap with the goal of widening access to high quality financial guidance. Indeed, only around 8.6% of UK adults received regulated financial advice in the twelve months to May 2024, and half of advisers have stopped serving less wealthy clients. The Financial Conduct Authority estimates that 7M adults with at least £10K in cash savings may be missing out on the benefits of long term investing. Clove aims to close this structural gap by building a modern institution able to support a far broader population with consistency, trust and transparency.

Our long-term partnership

We have known Alex for more than a decade and backed him before. He and Christian bring the experience of building and scaling complex fintech and marketplace platforms. Christian founded Paddle and scaled it into a global payments infrastructure platform serving software companies around the world. Alex founded Trouva which created a novel consumer marketplace for independent retailers in Europe. Their shared background in regulated operations, financial infrastructure and global distribution positions them well for the challenge of rebuilding the wealth industry. Both founders have also experienced the gaps in the current advisory market personally which gives them strong conviction and a clear understanding of consumer needs.

A new standard for wealth advice

Air Street Capital invests in Clove as the first AI-native wealth institution designed for the mass affluent. This investment reflects our belief that category-defining companies in financial services will be AI-native from day one. We believe Clove represents a step change in how financial guidance will be delivered over the next decade. The company combines the humanity and regulatory discipline of professional advisors with the scale, consistency and analytical power of AI. This combination has the potential to expand access to high quality advice for millions of households who have been underserved for years.

As AI transforms financial planning globally, Air Street Capital is committed to backing the institutions that will define this new category. We are excited to support Christian, Alex and the Clove team as they build a new institution for the mass affluent and set a new standard for modern wealth management.

Stop Funding Swarms. Start Enabling Sources.

We are entering a strange phase of the “innovation” economy.

Everywhere I see the same pattern:

committees, panels, and “ecosystems” throwing fundamentally incompatible frameworks into one pot – just enough conceptual noise to justify a funding proposal and a new layer of administration.

The result is not intelligence. It is swarm-mode redundancy.

There is a different option.

If you have energy, capital, or positional power, you can either

• spend it on tactical games with stressed, ego-driven competitors in pseudo-democratic committees,

or

• align with a coherent, life-long, cross-disciplinary framework that already integrates cumulative human knowledge and is now scalable through AI.

I call these two roles:

• Minds of Integrity – those who protect and enable the conditions for real intelligence to act.

• Minds of the Core – rare polymathic thinkers on mission, whose unique trajectories have produced truly integrative frameworks, not just another local method.

The real question for serious decision-makers is not:

> “Which swarm should I join?”

It is:

> “Which Core do I want to enable – and what future does this make structurally possible?”

My own work – the Sapiopoietic Core and the Epistemic Integrity Umbrella – is precisely such a framework: an orientation architecture for AI-saturated societies that protects subject autonomy instead of consuming it.

If you recognise yourself as a Mind of Integrity with long-term leverage (foundation, family office, fund, or institutional role) and you prefer enabling a coherent source over feeding the next swarm, feel free to reach out.

You don’t need another committee.

You need a framework that already knows what it is doing.

— Leon Tsvasman

If you recognise yourself as a Mind of Integrity with long-term leverage (foundation, family office, fund, or institutional role) and you prefer enabling a coherent source over feeding the next swarm, feel free to reach out.

For a deeper sense of the underlying architecture, see:

“Designing the Epistemic Integrity Layer”

https://open.substack.com/pub/leontsvasmansapiognosis/p/designing-the-epistemic-integrity

You don’t need another committee.

You need a framework that already knows what it is doing.