The power of non-consensus

Reflections on RAAIS, company creation, and the importance of swinging big

Prefer audio? Listen to this post here.

Introduction

As we build out this year’s State of AI Report, the Guide to AI is taking its customary holiday. We’ll soon be following up with our takeaways from this year’s Research and Applied AI Summit, which we hosted in June. In the meantime, the event prompted some wider reflections on entrepreneurship, the funding process, and bluntly, just how difficult building a killer AI-first company is in practice.

Last year, we closely reviewed almost 450 opportunities and assessed countless more ideas at their earlier stages. After working through all of these, we made only three seed investments. Every time we pass on an opportunity, we tag it in our CRM with a reason. The most common by far is that the opportunity was ‘unexciting’.

So, what makes for an exciting opportunity?

At Air Street, we search for ideas that are non-consensus today but have the potential to flip into being voted consensus by the market in a few years' time. We see this in founders who are working on unfashionable ideas that are difficult to pull off. These teams have a deep-seated conviction that the weight of evidence is on their side and the timing is right to chip away at the problem.

It’s easy to say this in abstract theoretical terms, so with several RAAIS talks from some highly accomplished founders still fresh in our minds, let’s boil this down to something more concrete.

Defining non-consensus

First and foremost, ‘non-consensus’ does not equate to insane or whacky for the sake of it. There is a subset of ideas that are non-consensus simply because they are bad, not because investors aren’t sophisticated enough to appreciate them.

When we look at a solid non-consensus idea, there are a few things that they often have in common.

Firstly, and (somewhat obviously), they’re unfashionable. This can take on a few different dimensions. It can be in the choice of:

Domain - picking an industry or use case that has been historically neglected by your peers whether it’s because they don’t like it (e.g. defense) or it’s considered dull (e.g. health and safety);

Challenge - choosing a subdomain where people haven’t tried to apply AI or existing approaches have hit a dead-end;

Approach - tackling the challenge in a way that differs from perceived wisdom among either researchers or founders and investors.

It’s possible to build a great business by doing only one or two of the above, but if you do none of them - you’ve hit consensus.

Secondly, there’s a real customer or potential to generate real value. Another obvious, but frequently overlooked concept. This is often misconstrued as just meaning ‘is this potentially useful’, but it’s actually slightly more nuanced.

It’s not just about imagining if there’s a hypothetical customer for a product, but that:

They are prepared to pay for more than a proof of concept;

The value add is sufficiently great that they would be prepared to change their workflow, train their team, or potentially lose staff;

The solution is better than other market offerings, a general purpose tool, or simply not applying AI to the challenge at all.

This last point is important. While we believe that much of the economy will be remade AI-first, there will still be tasks that can be solved more efficiently with a few lines of SQL or by talking to people.

Finally, the problem will take a few years to solve, well. If an idea essentially ‘works’ from day one then there’s a 99% chance that either someone else is already doing it or an incumbent with a huge budget could easily replicate it. For example, a large number of bespoke “LLMs but for X” applications will likely struggle to compete long-term with frontier model builders offering cheap API access and long context windows.

It’s hard for AI-first start-ups to build traditional moats. After all, LLMs went from being pioneered by OpenAI to commoditized in less than two years. But 2-3 years is enough time to build up brand recognition, gather proprietary data, and build customer loyalty by demonstrating value and creating strong habits.

Once timelines become longer than this, there’s a greater chance companies just run out of money before they have enough to prove to unlock more. If you’re targeting a 10-15 year horizon, you’re increasingly likely to be gambling on big research breakthroughs or major macro shifts.

Start-ups working on challenges like nuclear fusion or hydrogen power both have to overcome real technical hurdles, while hoping governments will reverse the direction of energy policy and rapidly invest in building out highly costly infrastructure. This might happen, but it’s a stretch for the traditional venture model.

RAAIS case studies

To make this more real, RAAIS helpfully furnishes us with examples of successful founders talking through their own journeys.

Synthesia

Our first speaker, Jonathan Starck, the Chief Technology Officer at Synthesia, who are pioneering the use of generative AI to create photo-real videos of people. When the company was founded in 2017, text-to-video barely existed as a research field, let alone a commercial proposition. Back then, the state of the art were generative adversarial networks, which struggled to produce clear, stable videos of any length.

The Synthesia team had a conviction that we were moving towards a video-first world based on changing patterns in the consumption of content. Members of the team had first-hand experience of just how cumbersome making high quality videos is.

Even for relatively simple corporate content, the process of producing a script, finding actors, shooting, post-production, and editing could take months and large amounts of money. Because it was so expensive, you had little flexibility and had to create one piece of content that could be used for every audience: the lowest common denominator.

They had the conviction that AI could eventually solve this problem, but they knew it would be a multi-year process. After all, going into 2019, transformer-based models were only beginning to become available for single-image generation. Waiting for DeepMind or OpenAI to solve it for them wasn’t an investable proposition, so the team cut the challenge down into smaller chunks, so they could find ways of delivering value in the interim.

At first, they focused on using GANs to develop deep fake technology for lip-syncing, so customers could dub a video into any language convincingly. It took another 2-3 years to get to text-to-video with avatars and then achieving product-market fit.

The team were consistently opinionated about where the technology would go next, but they were pragmatic about the short-term. For example, in 2022, the team had made progress on convincing 3D avatars created via NERFs. While they represent a significant technical leap, they still rely on replay (relying on pre-recorded video) and are challenging to edit.

So they doubled down on making better and more authentic 2D avatars while differentiating themselves from an emerging tribe of companies working on replay. This led them to focus on building a generative model with diffusion to make avatars more expressive and natural.

Wayve

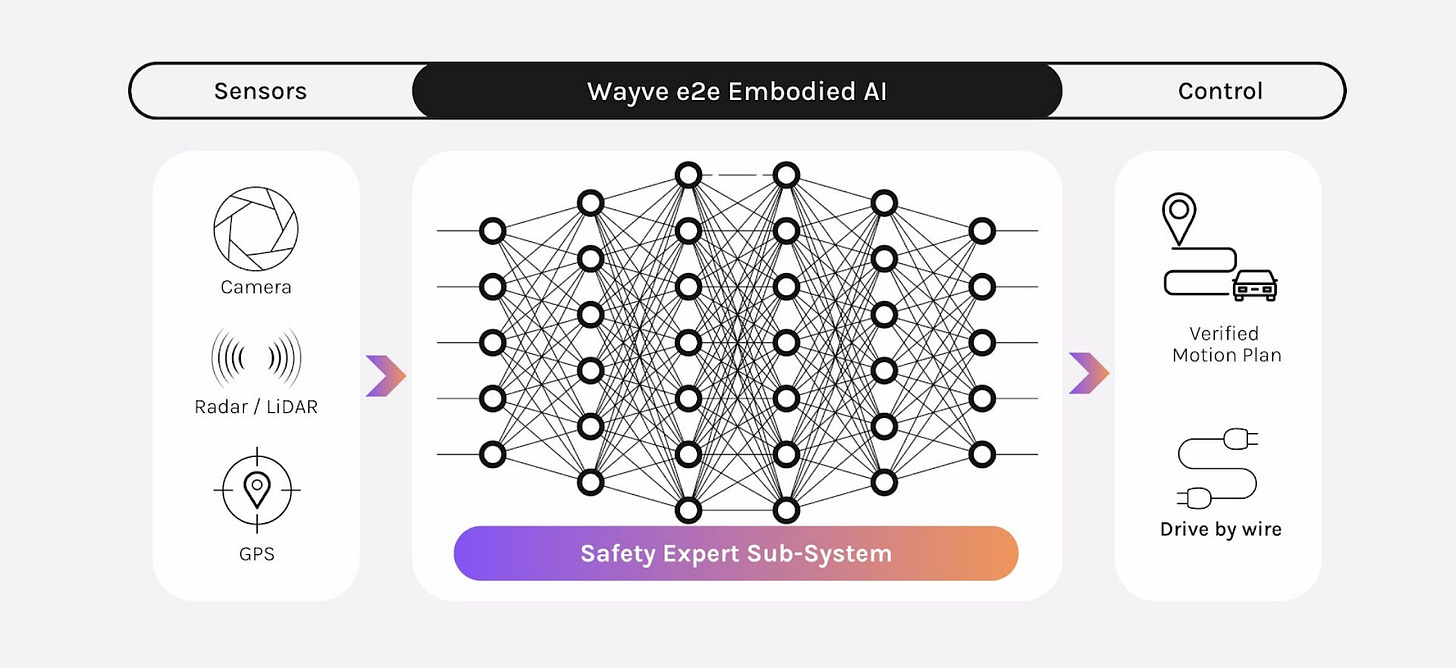

Fresh from raising his $1.05B Series C, Alex Kendall, the Co-Founder and CEO of Wayve, joined us to talk about his journey from PhD student to growth stage company leader. Wayve was essentially in a minority of one in its approach to self-driving, embracing end-to-end learning.

In an end-to-end system, a single neural network maps raw sensory inputs to driving actions, without explicitly programmed intermediate steps. It instead implicitly learns to perform tasks like object detection and path planning via a combination of supervised learning from human driving demonstrations and reinforcement learning, rather than these intermediate representations being hardcoded.

By contrast, other teams working on self-driving pursued a modular approach, where all these intermediate tasks were broken down into distinct steps, using their own models, some of which were hand-engineered. While end-to-end learning systems existed, they were typically seen as too compute-intensive or as ‘black boxes’, while modular systems intuitively align more with how humans conceptualize driving.

However, Alex’s previous work in robotics (another dimension of ‘embodied AI’) had led him to become skeptical of these traditional approaches, as he saw their brittleness firsthand. It was possible to hack around parameters and thresholds to throw together plausible demos, but these systems disintegrated on first contact with the real-world. In the meantime, he’d seen the success of DeepMind’s end-to-end Deep-Q learning solve the control of Atari games, while his own personal experimentation with end-to-end image segmentation systems displayed successful generalization.

While parts of the approach changed as the field evolved (e.g. swapping out CNNs for multimodal transformers), the team had conviction that it was a question of if, not when, the field would start moving towards end-to-end.

Considering the complexity of the task, self-driving doesn’t fall into the category of tasks that can easily be solved well and deployed commercially in 2-3 years. But the Wayve team were good at moving quickly and demonstrating incremental progress. For example, the company was founded in 2017, but within a year, they were able to share the first results of trials on UK roads.

Vercel

We were also joined by Jared Palmer, the VP of AI at Vercel, the frontend cloud platform. We’ll cover Jared’s talk on generative application design in our Sunday newsletter, but the wider Vercel story is a perfect encapsulation of the non-consensus to consensus journey.

Back in 2015, Vercel (or ZEIT as it was known then) successfully capitalized on several trends that had yet to hit the mainstream.

First of all, a counter-cultural focus on serverless architecture and edge computing. Amazon had only introduced AWS Lambda late the previous year and few people understood or took the idea of running applications without managing servers terribly seriously. Vercel, however, understood their latent potential to offer automatic scaling and cost-efficiency, and the potential for developers to concentrate more on writing code and less on managing infrastructure.

This latter point is crucial. Vercel grasped the importance of the developer experience from the beginning and targeted it with a laser-like focus. This gave them an immediate advantage over incumbents, who primarily catered to big enterprises with dedicated ops teams and assumed that developers wouldn’t be directly involved in deployment or hosting. The rise of cloud services, the emergence of DevOps, and an accelerating start-up boom rendered this view increasingly outdated.

Finally, Vercel spotted the potential of three connected web technologies that established platforms had avoided adopting due to a combination of their relative immaturity and the inconvenience of adapting. Guillermo, Vercel’s founder, created Next.js and the company provides first-class support for the framework for building interactive web apps, while also promoting static site generation and the JAMstack architecture. This approach pre-builds web pages and serves them from content delivery networks, using JavaScript for dynamic features. This was a significant shift from 2015-era web development practices, but offered better performance and security compared to traditional server-rendered sites.

A counter-example?

Sets of rules about entrepreneurship are rarely comprehensive. There is another model, exemplified by Thore Graepel, who heads computational science at Altos Labs.

Altos Labs emerged from stealth in 2022 with a $3B war chest, led by an all-star cast of scientists from GSK, the National Cancer Institute, and GRAIL. Thore was previously a senior researcher at Google DeepMind and co-invented AlphaGo.

So far, like many labs working on longevity and reversing the process of aging (e.g. Retro Biosciences or Calico), Altos has not shared significant detail on its work and has not publicly shared its timelines. But, bluntly, when you have a founding team with a sufficiently impressive track record and deep-pocketed backers who aren’t worried about traditional returns horizons, the ‘rules’ just don’t apply in the same way. Unfortunately, the stars rarely align like this for many first-time entrepreneurs.

Closing thoughts

One of the reasons we enjoy hosting RAAIS is that our different speakers exhibit the pay-off of swinging big. We see that in businesses that have scaled, papers that have unlocked new research directions, and products that are reshaping their sectors.

We’ve written in the past about the perils of herding, when a certain idea or sector becomes fashionable among investors, leading to a rapid influx of capital into a string of near-identical companies. This kind of herding isn’t just bad for VC returns - it can have real knock-on consequences. Anduril co-founder Trae Stephens has warned that “hype culture slows the rate of innovation by denying capital to entrepreneurs pursuing genuinely world-changing technologies” while “hype-driven valuations can be a burden, damaging the long-term prospects of the company”.

None of the businesses above got off the ground as a result of this kind of buzz, but they’re all bringing about a vibe shift of their own.